Learn

The essentials to get started using Perpetual PoolsTo use Perpetual Pools, you’ll need to be on a network called Arbitrum. Arbitrum is an Ethereum L2, which means it has the security of the Ethereum blockchain but is cheaper and faster to use. Once you’re connected, minting leveraged tokens is a breeze. Check out our Arbitrum guide to get set-up.

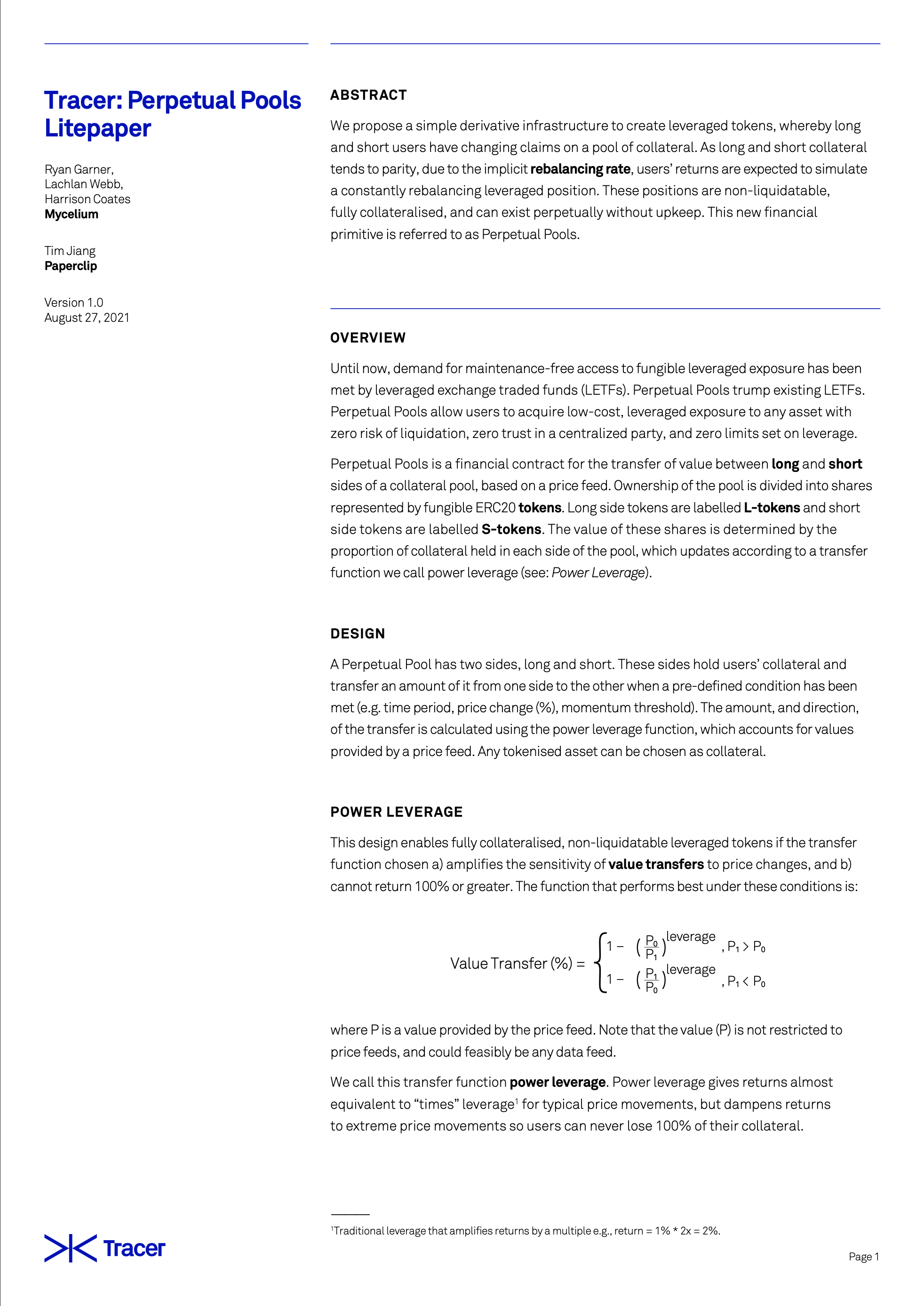

Normally, to trade with leverage you need to borrow money. Borrowing lets you take on a bigger position than you could get with your initial capital, so, once the debt is paid off, any profits or losses you make are amplified. With Tracer, you can get leveraged exposure without borrowing or worrying about margin calls and liquidations. Read more about Tracer’s Power Leverage here.

Yes. Perpetual Pools are a marketplace for leveraged tokens, while perpetual swaps simulate spot trading with margin. They are both derivatives, but, unlike perpetual swaps, you don’t need an account with an exchange to trade Perpetual Pool tokens. That’s because the tokens act most like a leveraged ETF, where positions are transferable. Read more here.

Tracer Research

Gain a more in-depth understanding of the TracerProtocol and its capabilities.

Tracer Drop

The latest research from Tracer and the RMIT BlockchainInnovation Hub. Every fortnight on Twitter and YouTube.

DeFi has given the ability to access a blue-chip NFTs in the same way we might have financial instruments around property rentals. Now we can point derivatives or other financial contracts to given attributes of products in a market. With Tracer’s derivative infrastructure, the goal is to open up new financial markets that combine all components of the digital future across Web3 and the Metaverse. Open-sourced, decentralized and democratized.